Nearly 9W companies closed, and a large number of factories were forcibly closed…

Due to low labor costs, low production materials, and policy support, Vietnam has attracted many overseas companies to build factories in Vietnam in recent years. The country has become one of the world’s major manufacturing centers, and even has the ambition to become the “next world factory”. . Relying on the development of the manufacturing industry, Vietnam’s economy has also soared, becoming the fourth largest economy in Southeast Asia.

However, the raging epidemic has caused Vietnam’s economic development to face tremendous challenges. Although it was a rare “model country for epidemic prevention” before, Vietnam has been “unsuccessful” this year under the impact of the Delta virus.

Nearly 90,000 companies closed, and over 80 US companies “suffered”! Vietnam’s economy faces huge challenges

On October 8, important people in Vietnam have stated that due to the impact of the epidemic, the national economic growth rate this year is likely to be only about 3%, which is far lower than the previously set target of 6%.

This concern is not unfounded. According to the statistics of the Vietnam Statistics Bureau, in the first three quarters of this year, about 90,000 companies have suspended operations or went bankrupt, and 32,000 of them have already announced their dissolution, an increase of 17.4% compared to the same period last year. . The fact that Vietnam’s factories do not open their doors will not only affect the country’s economy, but also “affect” the overseas companies that placed orders.

The analysis pointed out that the economic data of Vietnam in the third quarter were so ugly, mainly because the epidemic broke out more and more during this period, factories were forced to close, cities were forced to blockade, and exports were hit hard…

Zhou Ming, a manufacturer of second-hand mobile phones and mobile phone accessories in Hanoi, Vietnam, said that his own business cannot be sold domestically, so now it can only be regarded as basic living.

“After the epidemic broke out, my business can be said to be very bleak. Although work can be started in areas where the epidemic is not too severe, the entry and exit of goods is restricted. The goods that could exit customs within two or three days are now postponed to half a month to one month. In December, the order naturally decreased.”

It is reported that from mid-July to late September, 80% of Nike’s shoe factories and nearly half of its garment factories in southern Vietnam have been closed. Although it is predicted that the factory will resume work in phases in October, it will still take several months for the factory to go into full production. Affected by insufficient supply, the company’s revenue in the first quarter of fiscal year 2022 is still lower than expected

CFO Matt Friede said, “Nike lost at least 10 weeks of production in Vietnam, which created an inventory gap.”

In addition to Nike, Adidas, Coach, UGG and other US companies with mass production operations in Vietnam have all been impacted.

When Vietnam was deeply caught in the epidemic and its supply chain was interrupted, many companies began to “rethink”: Was it correct to move production capacity to Vietnam? An executive of a multinational company said, “It took 6 years to build a supply chain in Vietnam, and it only took 6 days to give up.”

Some companies are already planning to relocate their production capacity back to China. For example, the CEO of an American shoe brand said, “China is currently one of the few places in the world where goods can be obtained.”

With both the epidemic and the economy sounding the alarm, Vietnam is anxious.

On October 1st, according to TVBS, Ho Chi Minh City, Vietnam, abandoned the zero reset and announced the lifting of the anti-epidemic blockade in the past three months, allowing industrial parks, construction projects, shopping malls, and restaurants to resume operations. On October 6, a person familiar with the matter said: “Now we are slowly resuming work.” Some estimates say that this may resolve the crisis of Vietnam’s factory migration.

The latest news on October 8 shows that the Vietnamese government will continue to force the plant in the Nen Tak Second Industrial Zone in Dong Nai Province to suspend work for 7 days, and the suspension period will be extended to October 15. This means that the suspension of Japanese companies in factories in this area will be extended to 86 days.

To make matters worse, during the company’s two-month shutdown period, most Vietnamese migrant workers have returned to their hometowns, and it is difficult for foreign companies to find enough labor if they want to resume production at this time. According to Baocheng Group, a world-renowned shoe manufacturer, only 20-30% of its employees returned to work after the company issued the resumption notice.

And this is just a microcosm of most factories in Vietnam.

Double shortage of order workers makes it difficult for companies to resume work

A few days ago, the Vietnamese government is preparing to gradually restart economic production. For Vietnam’s textile, apparel and shoe industries, it is facing two major difficulties. One is the shortage of factory orders and the other is the shortage of workers. It is reported that the Vietnamese government’s request for the resumption of work and production of enterprises is that workers in enterprises that resume work and resume production must be in epidemic-free areas, but these factories are basically in epidemic areas, and workers naturally cannot return to work.

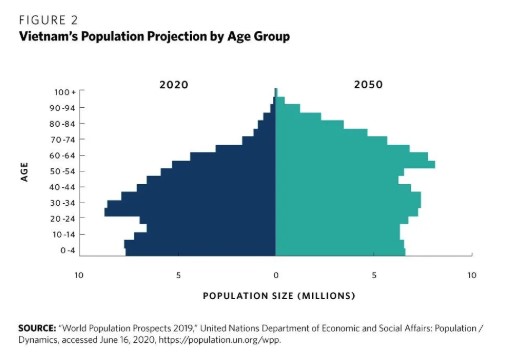

Especially in southern Vietnam, where the epidemic is the most severe, even if the epidemic is contained in October, it is difficult to return the original workers to work. Most of them returned to their hometowns to avoid the epidemic; for new employees, due to the implementation of social quarantine throughout Vietnam, The flow of personnel is very restricted, and it is naturally difficult to find workers. Before the end of the year, the shortage of workers in Vietnamese factories was as high as 35%-37%.

Since the outbreak of the epidemic to the present, Vietnam’s shoe product export orders have been lost very seriously. It is reported that in August, about 20% of shoe product export orders were lost. In September, there was a loss of 40%-50%. Basically, it takes half a year from negotiation to signing. In this way, if you want to make up the order, it will be a year later.

At present, even if the Vietnamese shoe industry wants to gradually resume work and production, under the situation of shortage of orders and labor, it is difficult for companies to resume work and production, let alone resume production before the epidemic.

So, will the order flow back to China?

In response to the crisis, many overseas companies have used China as a safe-haven export basket

The Vietnam factory of Hook Furnishings, an established American listed furniture company, has been suspended since August 1. Paul Hackfield, vice president of finance, said, “Vietnam’s vaccination is not particularly good, and the government is proactive about the mandatory closure of factories.” On the consumer demand side, new orders and backlogs are strong, and shipments caused by the closure of factories in Vietnam will be blocked. Shows up in the coming months.

Paul said:

“We returned to China when necessary. If we feel that a country is more stable now, this is what we will do.”

Nike’s CFO Matt Fried said:

“Our team is maximizing the production capacity of footwear in other countries and transferring garment production from Vietnam to other countries, such as Indonesia and China… to meet the incredibly strong consumer demand.”

Roger Rollins, CEO of Designer Brands, a large-scale shoe and accessories design, production and retailer in North America, shared the experience of peers deploying supply chains and returning to China:

“A CEO told me that it took him 6 days to complete the supply chain (transfer) work that took 6 years before. Think about how much energy everyone spent before leaving China, but now where you can buy goods Only China-it’s really crazy, like a roller coaster.”

LoveSac, the fastest-growing furniture retailer in the United States, has also re-transferred purchase orders to suppliers in China.

CFO Donna Delomo said:

“We know that inventory from China is affected by tariffs, which will cost us a little more money, but it allows us to maintain inventory, which gives us a competitive advantage and is very important for us and our customers.”

It can be seen that during the three months of strict Vietnamese blockade, Chinese suppliers have become emergency choices for large international companies, but Vietnam, which resumed work and production from October 1, will also add to the production choices of manufacturing companies. Variety.

The general manager of a large shoe company in Guangdong analyzed, “(Orders are transferred to China) This is a short-term operation. I know very few that the factories are transferred back. (Nike, etc.) Large multinational companies usually make payments all over the world. There are other factories. (Vietnam factories are closed). If there are orders, we will do them elsewhere. The main ones that are transferred are in Southeast Asian countries, followed by China.”

He explained that some companies have previously transferred most of the production line capacity, and there is very little left in China. It is difficult to make up for the capacity gap. The more common practice of companies is to transfer orders to other shoe factories in China and use their production lines to complete tasks. Instead of returning to China to set up factories and build production lines.

Order transfer and factory transfer are two concepts, with different cycles, difficulties, and economic benefits.

“If the site selection, plant construction, supplier certification, and production start from scratch, the shoe factory’s transfer cycle will probably be one and a half to two years. Vietnam’s suspension of production and production lasted less than 3 months. In contrast, the transfer of orders Enough to resolve a short-term inventory crisis.”

If you do not export from Vietnam, cancel the order and find another place? Where is the gap?

In the long run, whether the “peacocks fly southeast” or the return of orders to China, investment and production transfer are the independent choices of enterprises to seek advantages and avoid disadvantages. Tariffs, labor costs, and recruitment are the important driving forces for the international transfer of industries.

Guo Junhong, executive director of Dongguan Qiaohong Shoes Industry, said that last year some buyers clearly requested that a certain percentage of shipments should come from Southeast Asian countries such as Vietnam, and some customers had a tough attitude: “If you don’t export from Vietnam, you will cancel your order and look for someone else.”

Guo Junhong explained that because exporting from Vietnam and other countries that can enjoy tariff reductions and exemptions has lower costs and greater profit margins, some foreign trade OEMs have transferred some production lines to Vietnam and other places.

In some areas, the “Made in Vietnam” label can preserve more profits than the “Made in China” label.

On May 5, 2019, Trump announced a 25% tariff on US$250 billion of Chinese exports to the United States. Products, industrial machinery, household appliances, luggage, shoes, and clothing are a heavy blow to foreign trade companies that take the route of small profits but quick turnover. In contrast, Vietnam, with the United States as the second largest exporter, provides preferential treatments such as exemptions from import tariffs in export processing zones.

However, the difference in tariff barriers only accelerates the speed of industrial transfer. The driving force of the “peacock flying southeast” occurred long before the epidemic and Sino-US trade frictions.

In 2019, an analysis by Rabo Research, a think tank of Rabobank, pointed out that the earlier driving force was pressure from rising wages. According to a survey conducted by the Japan External Trade Organization in 2018, 66% of Japanese companies surveyed said that this is their main challenge for doing business in China.

An economic and trade study conducted by the Hong Kong Trade Development Council in November 2020 pointed out that the 7 Southeast Asian countries have labor cost advantages, and the minimum monthly wage is mostly below RMB 2,000, which is favored by multinational companies.

Vietnam has a dominant labor force structure

However, although Southeast Asian countries have advantages in manpower and tariff costs, the actual gap also exists objectively.

A manager of a multinational company wrote an article in May to share his experience of managing a factory in Vietnam:

“I am not afraid of a joke. At the beginning, the labeling cartons and packaging boxes are imported from China, and sometimes the freight is more expensive than the value of the goods. The initial cost of building a supply chain from scratch is not low, and the localization of materials takes time.”

The gap is also reflected in talents. For example, engineers in mainland China have a lot of work experience of 10-20 years. In Vietnamese factories, engineers have just graduated from university for a few years, and employees must start training with the most basic skills. .

The more prominent problem is that the customer’s management cost is higher.

“A very good factory does not need customers to intervene, they can solve 99% of the problems by themselves; while a backward factory has problems every day and needs the help of customers, and it will make repeated mistakes and make mistakes in different ways.”

Working with the Vietnamese team, he can only get in touch with each other.

The increased time cost also magnifies the management difficulty. According to industry insiders, in the Pearl River Delta, delivery of raw materials on the same day after the order is placed is common. In the Philippines, it will take two weeks to pack and export the goods, and the management needs to be more planned.

However, these gaps are hidden. For large buyers, the quotations are visible to the naked eye.

According to the manager of the multinational company, for the same circuit board equipment plus labor costs, Vietnam’s quotation in the first round was 60% cheaper than similar factories in mainland China.

To hit the market with a low price advantage, Vietnam’s marketing thinking has the shadow of China’s past.

However, many industry insiders said, “I am very optimistic about the prospects of China’s manufacturing industry based on technological strength and manufacturing level improvement. It is impossible for the manufacturing base camp to leave China!”

CHINA COME ON. JINAN UBO CNC MACHINERY CO.LTD COME ON….

Post time: Oct-19-2021